- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Dollar Collapses, Stocks and Gold Shine After Inflation Data

Dollar gets decimated by ‘cold’ US inflation report

Stock markets hit new highs, gold powers higher

Coming up - US producer prices and ECB minutes

US CPI slams dollar lower

A ‘cold’ US inflation report sent shockwaves across global markets yesterday, as investors reassessed the path for interest rates. Annual inflation as measured by the consumer price index clocked in at 3% in June, just a shade lower than the consensus estimate of 3.1%, but a sharp slowdown from 4% in the previous month.

Core inflation - which strips out energy and food prices - fell to 4.8% from 5.3% in May, also undershooting market estimates of 5.0%. These numbers reaffirm that US inflation is cooling off, although the Fed hasn’t won the war yet, as underlying price pressures are still a long way from the 2% target and the tightness in the labor market suggests the rest of the journey might be the most difficult part.

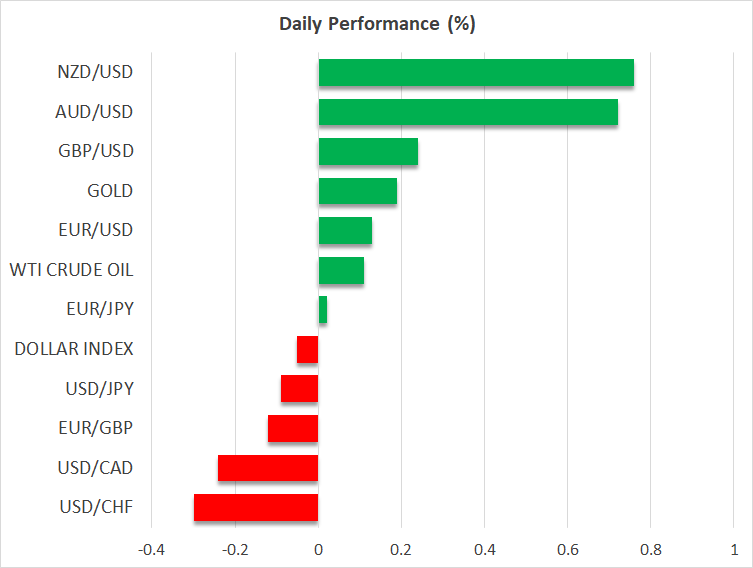

The market reaction was explosive, with the biggest casualty being the US dollar, which fell through the trapdoors to hit a new 15-month low against a basket of major currencies. This mirrored a similarly sharp drop in US yields, as traders concluded that July will probably be the Fed’s final rate increase of this cycle.

With rate differentials compressing, it was the yen’s turn to shine. Dollar/yen has fallen by almost 4% since Friday, a dramatic move even for yen standards, which has been fueled both by the unwind in Fed rate bets and by speculation that the Bank of Japan might finally adjust its yield curve control strategy later this month.

Stocks and gold party

Stock markets went into overdrive in the aftermath of the inflation report, extending the impressive rally this year. The S&P 500 stormed higher to hit its best levels in 15 months, closing just 7.2% away from its record high as the cold inflation report reinforced optimism that the US economy can achieve a soft landing.

The spotlight will now shift to the earnings season, which will fire up tomorrow with several major US banks reporting. Similar to last quarter, analyst estimates have declined heading into this earnings season, setting the bar so low that corporate America will probably have an easy time jumping over it and delivering positive earnings surprises. This dynamic might be the next source of power for equity markets.

Gold prices enjoyed a fantastic session too, piercing above some key resistance levels to trade above the $1,960 level early on Thursday. With real US yields and the dollar falling without a parachute, investors got the green light to load up on bullion, which is now less than 6% away from record highs. The next major barrier to watch on the upside is the $1,970 - $1,975 region, which acted both as support and resistance this year.

ECB minutes and US producer prices

Elsewhere, the Bank of Canada raised interest rates yesterday, yet the reaction in the FX market was minimal as the move was widely expected and the central bank refrained from clearly signaling that more hikes are on the way. In China, a batch of disappointing trade numbers passed almost unnoticed.

As for today, the main event will be the latest round of US producer prices, which could help cement expectations that inflation is on its way down. Jobless claims will also be closely watched for any clues on the health of the US labor market. Over in Europe, the minutes of the latest ECB meeting will be released, although they are unlikely to contain any major euro-impacting revelations.

Related Articles

The Nasdaq has been the top performer on Wall Street this year, thanks to easing inflation and receding fears over further rate hikes. As such, I used the InvestingPro stock...

For many months we have been saying (in our weekly podcast|videocast) that June, July and August would be the months we would see headline inflation collapse to the mid to low 3%...

Investors are facing two major potential catalysts over the next month - inflation in the near-term and Q2 earnings in the longer-term. The next big domino to fall will be this...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.