- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

S&P 500: 4500 in Reach. What’s Next?

At the end of June, see here, we found using the Elliott Wave Principle (EWP) for the S&P 500 (SPX) that:

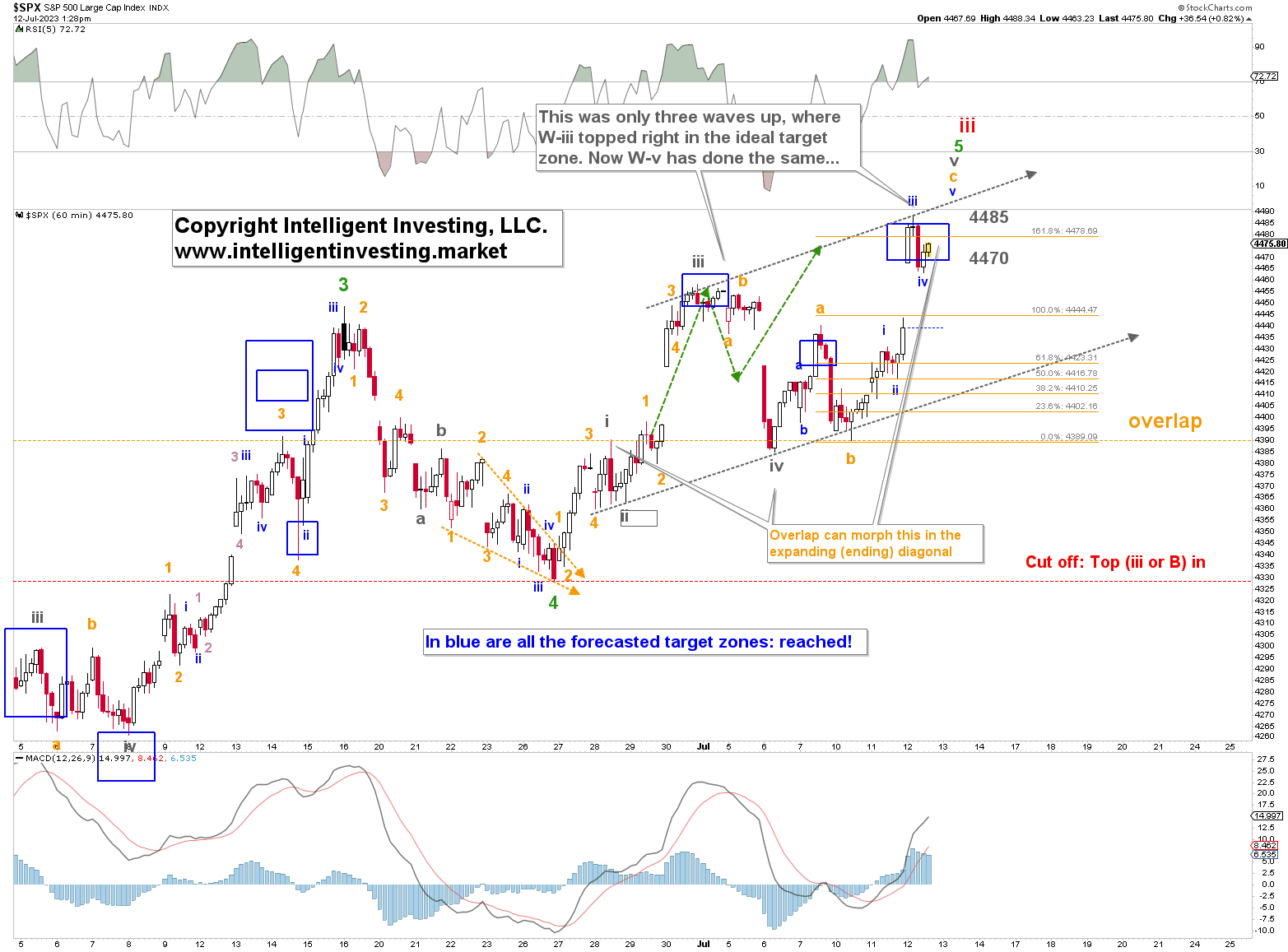

“...The index to complete the orange W-5 of the grey W-iii at ideally $4460+/-5, then a grey W-iv down to ideally $4425+/-5 followed by a last grey W-v to ideally $4470-4485. … This upside target fits well with the 161.80% extension of red W-i, measured from red W-ii, and the 76.40% retrace of the 2022 Bear Market. Both are ~$4505+/-5.”

The index peaked that same day our article was posted at $4458 and dropped to $4385 on July 6, only to now sit at $4480s. See Figure 1 below. Thus, the SPX topped in the ideal target zone for grey W-iii, bottomed below the ideal W-iv target zone, and reached the ideal W-v target box. This means there were only three waves up from the June 26 low at $4328 to the $4458 high. Besides, there were also only three waves down to $4385. Thus, it appears the green W-5 to the $4470-4500 zone set forth four weeks ago is morphing into a (rare) expanding diagonal.

Figure 1

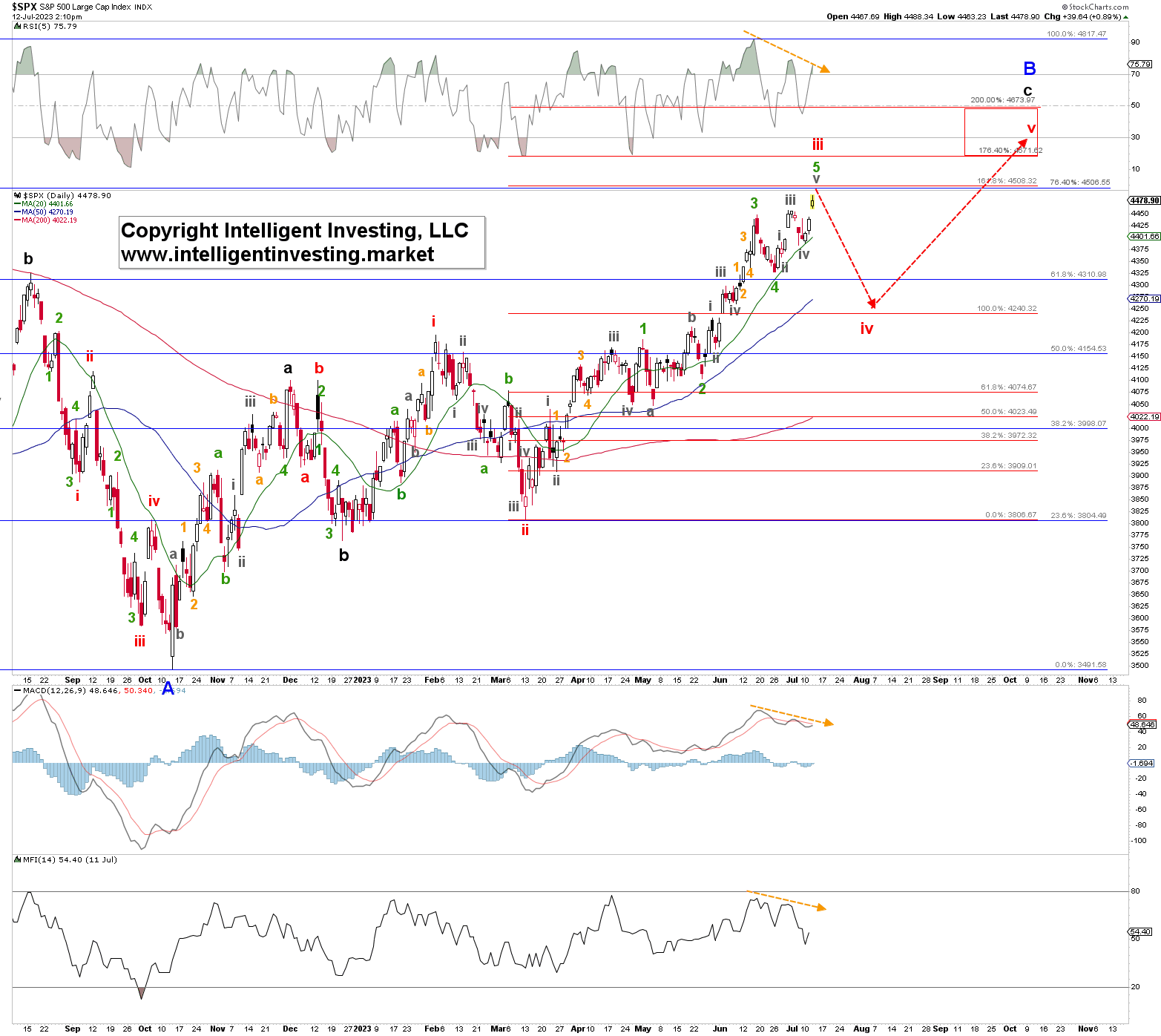

Thus, due to the hotter-than-expected ADP data last week the index took an unexpected detour but is still trying to fulfill its “inevitable destiny” of $4500+. Namely, as said in our last update, we still view the index in a counter-trend rally (Blue W-B), we anticipate a three-wave advance: black W-a, -b, and -c. The latter will subdivide into five waves: red W-i, ii, iii, iv, and v. See Figure 2 below. Of those five red waves, W-iii should ideally complete at the 161.8% extension ($4508). Typically, W-iv then moves back to around the 100.0% extension (~$4240) before W-v kicks in to ideally, the 176.4-200.0% Fibonacci-extensions ($4570-4675). In this case, green W-5 of red W-iii most likely morphed into the expanding (ending) diagonal.

Figure 2

Lastly, please note the negative divergences developing on the daily timeframe based technical indicators (TIs), such as the MACD. It means the index is moving higher with less strength, less momentum, and less liquidity. Although it is a condition and not a trigger, it must be noted and matches the EWP pattern of a completing 3rd wave. The index will have to drop below the red W-i (February 2) high at $4195 to strongly suggest the W-B counter-trend rally has completed and is working its way lower to the $2700-2900 zone. Please note these upside levels have been on our radar since October last year. See here when we were looking for the index to reach $4350-4650.

Related Articles

The last 18 months have been like an ice age for investment bankers brokering deals and young business owners looking to tap extra capital Several successful recent IPOs may...

Q2 earnings season kicks off with the banking sector entering the limelight Banking crisis concerns have abated following stress tests by the Fed Big players Citigroup, JPMorgan,...

Stocks have rallied since June, aided by significant capital inflows But some stocks have lagged behind Let's take a look at three such stocks trading below their target prices...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.