- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

S&P 500's Sell Signal, Nasdaq Edges Lower, Russell 2000 Bounces: What's Next?

A bit of a mixed bag on Friday as the Russell 2000 (IWM) managed to finish the day higher, while both the Nasdaq and S&P 500 close back at the open price, after a day built on a promise.

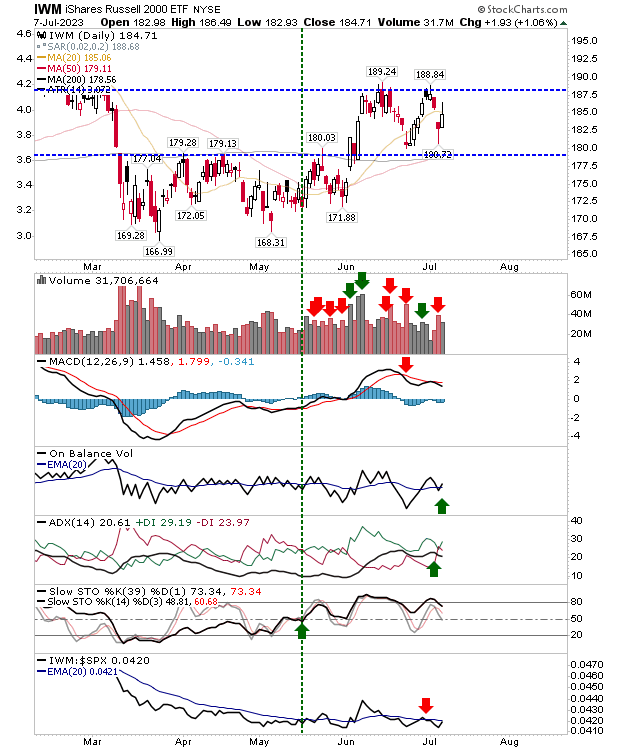

The Russell 2000 is the easiest to comment on, but it has the longest way to go before we consider it back to secular bullish form. Friday's higher close edged back a little on the test of its 20-day MA, although the buying was enough to reverse the 'sell' triggers in On-Balance-Volume and the ADX. However, at this stage of the base building process, a challenge and break of $188 is needed before we can look at what comes next.

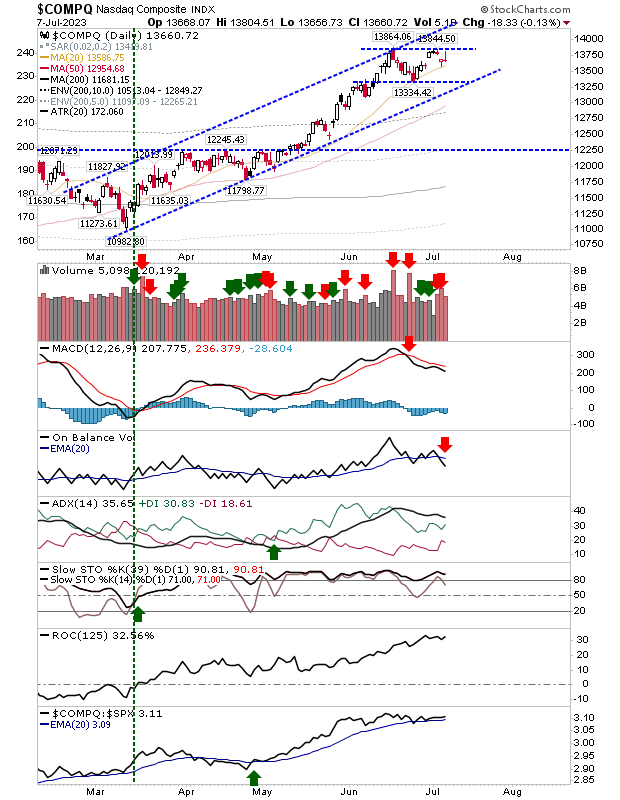

Next, we have the Nasdaq. It closed with a potentially bearish 'gravestone doji.' What curtails the damage a little is that the doji appeared within a mini-base of what still could turn into a double-top; 'gravestone doji' are particularly dangerous when they appear in isolation at the end of a rally as they mark reliable reversals. Technicals are mixed with bearish signals in the MACD and On-Balance-Volume offset by the bullish signals in ADX and Stochastics. The Nasdaq is also outperforming both the S&P 500 and Russell 2000.

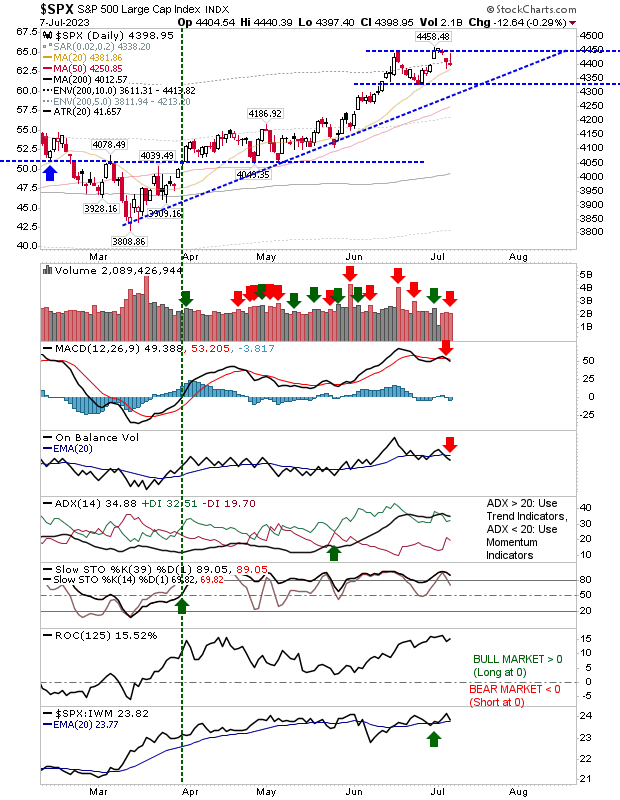

The S&P 500 had a similar experience as the Nasdaq, except the MACD switched back to a 'sell' trigger to go with the sell in On-Balance-Volume. While the S&P 500 is underperforming relative to the Nasdaq, it still has an edge over the Russell 2000 ($IWM).

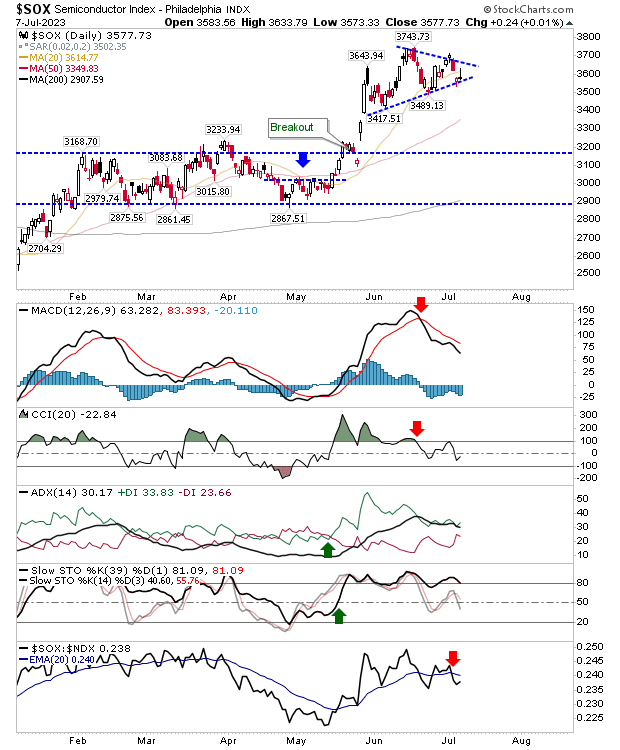

One interesting development to watch is the Semiconductor Index. While action in the Nasdaq and S&P 500 mirrors each other closely, the Semiconductor Index is shaping a bullish triangle/pennant. Momentum has managed to stay overbought during the development of this pattern, which is typically a good sign for a breakout higher. Let's see if it does.

Related Articles

The last 18 months have been like an ice age for investment bankers brokering deals and young business owners looking to tap extra capital Several successful recent IPOs may...

Q2 earnings season kicks off with the banking sector entering the limelight Banking crisis concerns have abated following stress tests by the Fed Big players Citigroup, JPMorgan,...

Stocks have rallied since June, aided by significant capital inflows But some stocks have lagged behind Let's take a look at three such stocks trading below their target prices...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.